Equip Them for Happily Ever After

EQUIP THEM FOR HAPPILY EVER AFTER

Prenuptial Adulting

“Mom, Dad, we’re getting married!"

“Wonderful, congratulations! Here’s what you both need to do first.”

Equipping newlyweds with essentials of responsibility leaves plenty of life yet to be discovered on their own. Adults understand that love isn’t oogly feelings; it’s hard choices. It’s putting your commitments and your money where your mouth is.

Many of the following steps also apply to one’s turning 18 years old. Becoming engaged adds urgency and a deadline.

Draft a budget based on one income.

Allocate any second income to your joint emergency fund, then to seeding retirement, then to discretionary spending. Commit to it by signing a printout. Revisit annually or when the situation changes, always with one income covering essentials.

Simplicity

Commit to erring on the side of simplicity in all things. Simplicity is not shirking responsibility; rather, it is leaning towards a minimalist approach. Stuff quickly accumulates. Every non-consumable item purchased requires maintenance, cleaning, storage space, and mental space. When you relocate, you either have to pack and pay to move it, sell/donate, or otherwise get rid of it. Not acquiring unnecessary stuff is way less taxing.

Spend less, earn more

What about skyrocketing inflation undermining your ability to live reasonably on one income?

Reduce your largest expenses by driving more economical vehicles and living in a smaller space. At the same time, what steps can both of you undertake to elevate your income? Rather than adding a college degree, look at skill certifications for growing markets. These are quicker and cheaper than degrees while conveying specific competencies for which employers pay higher wages. Part of your prospective employer interview (or periodic review with your current employer) should map out a clear path toward earning your next promotion.

Organize

Decide where and how you will manage your important documents and login credentials. Disorganization becomes discord!

Decide who will break ties on disagreements.

This is not a 100% decision. Each spouse should have tie-breaking “authority” depending on the area of life. Line those out now. Meet with a couple who has been married for at least a decade. Let them present you with some challenging scenarios that you will likely encounter to test your willingness to stick to your tie-breaking agreement.

Date night

Commit to a weekly inexpensive date of at least 2 hrs. Monthly do something that one spouse likes more than the other, then switch next month. This reinforces appreciation for things one spouse might not care for but the other likes a lot.

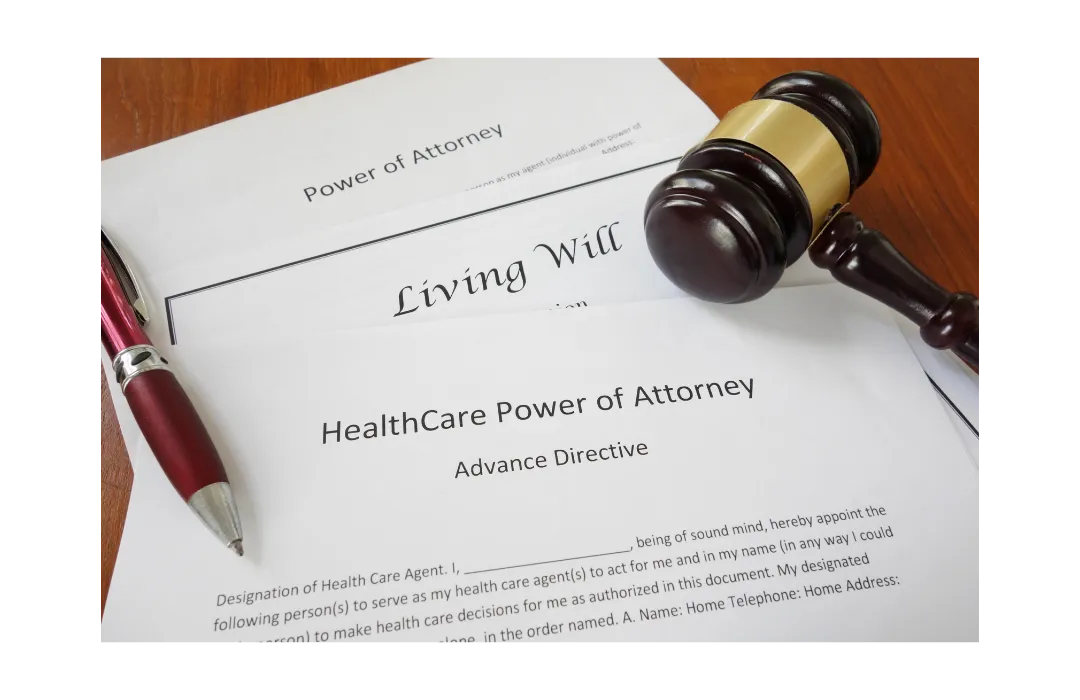

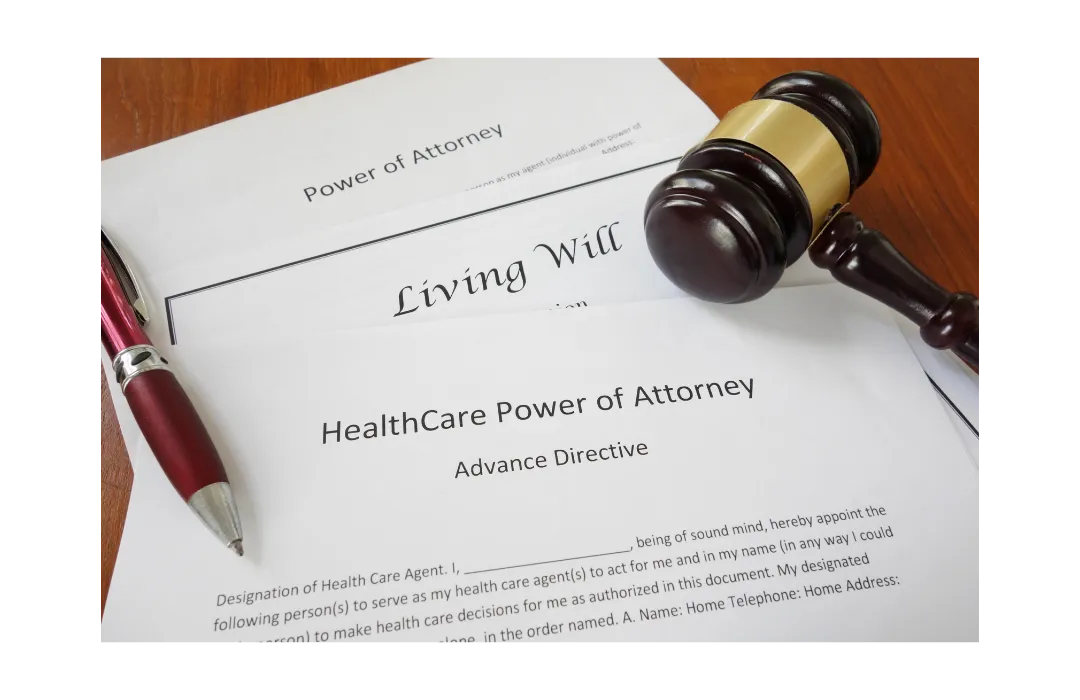

Initial steps toward legal empowerment

Complete your state’s Healthcare Advance Directive forms and registration. These include Living Will and Healthcare Power of Attorney forms. This exercise will certainly start conversations that would never happen on their own.

Basic Estate Plan

Medical and financial durable Powers Of Attorney and a will (must anticipate children and nominate guardians). Do that now. Resolve to see an estate planning attorney in the next 30 days.

Provide copies of your medical POAs to your primary care physicians and to your contingent agents, e.g. parents.

Quality, convertible term life insurance.

Base your Death Benefit on Human Life Value, not final expenses. The death benefit should be the maximum the insurance company will issue. Set a term of at least 20 years, preferably 30 if you plan to have several children. Select an A or better-rated issuer that is a top 5 in the permanent policy space. This could be the only time either fiancée is insurable, so part of the driver is locking in insurability. Include a Disability Waiver of Premium rider. There are many other factors you should discuss with an independent insurance agent, but these are minimum essentials.

This is easy to do. From e-app to e-issue can be less than a week with no paramed exam.

Review your employer benefits

Capture free or low-cost benefits. Note that employer group life insurance is cheap when you’re young, but does not substitute for owning your own policies. How to prove this? Your personal life insurance application does not ask about your employer group life. It does ask if you have other personally owned life insurance. Insurers only limit how much total death benefit you can have from personal policies. It is impossible to be over-insured because the life insurance companies prevent that.

Start filling your “never taxed again” bucket

You have no control over our country’s out-of-control debt and coming tax burden. You do have control over diversifying the tax status of your wealth.

Even if one of you has stellar employer benefits, start a Roth IRA for each of you right now. This could be $20/month but start. If your Married Filing Jointly income exceeds $214,000, then consider a maximum funded, minimum death benefit cash value life insurance policy for each of you at the same time you apply for your term life policies.

Complete your beneficiary forms

Beneficiary forms trump a will. Complete and submit (retain copies) beneficiary designation forms for ALL policies and accounts, including at work. Non-retirement accounts use a Transfer On Death or Payable On Death form.

Remind yourselves that nothing is free.

Free apps, free online trading, free social media—they ALL track, collect, categorize and SELL YOUR INFORMATION. And they ALL get hacked. There

are 533 million Facebook registrations/profiles on the dark web from a 2019 hack. Also hacked were Amazon, Apple, Capital One, Equifax, JPMorgan Chase, Kay Jewelers, Macy’s, Marriott, Toyota, and on and on.

Fees include “Value not delivered” or “Risks not explained.”

Revisit your auto insurance with an Independent Agent

You have much more to lose than when you were only responsible for yourself. If you plan a side gig that involves your vehicle, be up front with your agent. Using your vehicle for an undisclosed business likely means you have no coverage.

Love letter

Handwrite each other a love letter that affirms each of the above steps, and why those actions deepen your love for your spouse-to-be.

If you really want to put a bow on this, at your wedding reception present copies to your parents, in-laws, and wedding party.

Prenuptial Adulting

“Mom, Dad, we’re getting married!”

“Wonderful, congratulations! Here’s what you both need to do first.”

Equipping newlyweds with essentials of responsibility leaves plenty of life yet to be discovered on their own. Adults understand that love isn’t oogly feelings; it’s a journey of hard choices. It’s putting your commitments and your money where your mouth is.

Many of the following steps also apply to one’s turning 18 years old. Becoming engaged adds urgency and a deadline.

Draft a budget based on one income.

Allocate any second income to your joint emergency fund, then to seeding retirement, then to discretionary spending. Commit to it by signing a printout. Revisit annually or when the situation changes, always with one income covering essentials.

Simplicity

Commit to erring on the side of simplicity in all things. Simplicity is not shirking responsibility; rather, it is leaning towards a minimalist approach. Stuff quickly accumulates. Every non-consumable item purchased requires maintenance, cleaning, storage space, and mental space. When you relocate, you either have to pack and pay to move it, sell/donate, or otherwise get rid of it. Not acquiring unnecessary stuff is way less taxing.

Spend less, earn more

What about skyrocketing inflation undermining your ability to live reasonably on one income?

Reduce your largest expenses by driving more economical vehicles and living in a smaller space. At the same time, what steps can both of you undertake to elevate your income? Rather than adding a college degree, look at skill certifications for growing markets. These are quicker and cheaper than degrees while conveying specific competencies for which employers pay higher wages. Part of your prospective employer interview (or periodic review with your current employer) should map out a clear path toward earning your next promotion.

Organize.

Decide where and how you will manage your important documents and login credentials. Disorganization becomes discord!

Decide who will break ties on disagreements.

This is not a 100% decision. Each spouse should have tie-breaking “authority” depending on the area of life. Line those out now. Meet with a couple who has been married for at least a decade. Let them present you with some challenging scenarios that you will likely encounter to test your willingness to stick to your tie-breaking agreement.

Date night

Commit to a weekly inexpensive date of at least 2 hrs. Monthly do something that one spouse likes more than the other, then switch next month. This reinforces appreciation for things one spouse might not care for but the other likes a lot.

Initial steps toward legal empowerment

Complete your state’s Healthcare Advance Directive forms and registration. These include Living Will and Healthcare Power of Attorney forms. This exercise will certainly start conversations that would never happen on their own.

Basic Estate Plan

Medical and financial durable Powers Of Attorney and a will (must anticipate children and nominate guardians). Do that now. Resolve to see an estate planning attorney in the next 30 days.

Provide copies of your medical POAs to your primary care physicians and to your contingent agents, e.g. parents.

Quality, convertible term life insurance.

Base your Death Benefit on Human Life Value, not final expenses. The death benefit should be the maximum the insurance company will issue. Set a term of at least 20 years, preferably 30 if you plan to have several children. Select an A or better-rated issuer that is a top 5 in the permanent policy space. This could be the only time either fiancée is insurable, so part of the driver is locking in insurability. Include a Disability Waiver of Premium rider. There are many other factors you should discuss with an independent insurance agent, but these are minimum essentials.

This is easy to do. From e-app to e-issue can be less than a week with no paramed exam.

Review your employer's benefits

Capture free or low-cost benefits. Note that employer group life insurance is cheap when you’re young, but does not substitute for owning your own policies. How to prove this? Your personal life insurance application does not ask about your employer group life. It does ask if you have other personally owned life insurance. Insurers only limit how much total death benefit you can have from personal policies. It is impossible to be over-insured because the life insurance companies prevent that.

Start filling your “never taxed again” bucket

You have no control over our country’s out-of-control debt and coming tax burden. You do have control over diversifying the tax status of your wealth.

Even if one of you has stellar employer benefits, start a Roth IRA for each of you right now. This could be $20/month but start. If your Married Filing Jointly income exceeds $214,000, then consider a maximum funded, minimum death benefit cash value life insurance policy for each of you at the same time you apply for your term life policies.

Complete your beneficiary forms

Beneficiary forms trump a will. Complete and submit (retain copies) beneficiary designation forms for ALL policies and accounts, including at work. Non-retirement accounts use a Transfer On Death or Payable On Death form.

Remind yourselves that nothing is free.

Free apps, free online trading, free social media—they ALL track, collect, categorize and SELL YOUR INFORMATION. And they ALL get hacked. There are 533 million Facebook registrations/profiles on the dark web from a 2019 hack. Also hacked were Amazon, Apple, Capital One, Equifax, JPMorgan Chase, Kay Jewelers, Macy’s, Marriott, Toyota, and on and on.

Fees include “Value not delivered” or “Risks not explained.”

Revisit your auto insurance with an Independent Agent

You have much more to lose than when you were only responsible for yourself. If you plan a side gig that involves your vehicle, be up front with your agent. Using your vehicle for an undisclosed business likely means you have no coverage.

Love letter

Handwrite each other a love letter that affirms each of the above steps, and why those actions deepen your love for your spouse-to-be.

If you really want to put a bow on this, at your wedding reception present copies to your parents, in-laws, and wedding party.

We commit to completing Prenuptial Adulting prior to our wedding:

and

We have completed Prenuptial Adulting:

and

We commit to completing Prenuptial Adulting prior to our wedding:

and

We have completed Prenuptial Adulting:

and

Download here to print, sign witnessed by your closest Loved Ones, and keep in your wedding album.

Download here to print, sign witnessed by your closest Loved Ones, and keep in your wedding album.